Alert

The new Windfall Gains Tax (WGT) introduced by the Windfall Gains Tax and State Taxation and Other Acts Further Amendment Act 2021 commences on 1 July 2023. In broad terms, WGT applies to land rezoned after 1 July 2023. However, practitioners need to be across the issues now, particularly if negotiating long term sale contracts, or options, that will settle after that date that may then be subject to the WGT.

What's on this page?

This alert was originally published on 15 February 2022 and subsequently updated on 16 June 2023.

Summary

| The new Windfall Gains Tax (WGT) applies to most land in Victoria rezoned after 1 July 2023 with some limited exceptions | ||

| Practitioners negotiating long term sale contracts now, that will settle after that date, need to take WGT into account in negotiations and drafting of contracts | ||

| Most land in Victoria is susceptible to the tax in the event of a rezoning. There are some limited exemptions for specific types of property and / or rezonings. | ||

| Land that was subject to a contract or option entered into before 15 May 2021 may not be subject to the WGT under transition concessions, provided the terms of the contract are not altered after that date and the transfer of the land has not occurred prior to the WGT event. | ||

| The owner of the property is liable for WGT. | ||

| Liability to pay WGT is incurred when the rezoning occurs but can be deferred for up to 30 years. A first ranking charge will apply to the land until the WGT is paid. | ||

| There is a strict 2 month time limit to object to an assessment for WGT |

How does the tax work?

As explained in more detail below, whether there is any liability for WGT, and the amount payable, is determined based on the amount of the ‘value uplift’ attributable to a rezoning of the land. The value uplift is the difference between the value of the land after rezoning and the value of the land prior to the rezoning.

WGT is incurred by landowners when their property is rezoned and there is a resulting value uplift, after taking into account any deductions, of more than $100,000.

Property subject to the tax

Most land in Victoria is susceptible to the tax in the event of a rezoning. There are some limited exemptions for some land and types of rezoning.

Exempt Land

The main exemption is for residential land, as defined in s.36, of up to two hectares. The land must have a residential building or a building permit to build a residence must be in place. It must also be the only residential land owned by the taxpayer that is rezoned by the WGT event (s.37).

Generally speaking, residential land does not include land that is occupied primarily as commercial residential premises, residential care facilities, supported residential services or retirement villages. There may be some exceptions for individual units within such premises.

The Commissioner may give a waiver for the WGT for land owned by a charity if the land continues to be used for charitable purposes for 15 years after the WGT is incurred (s.41).

Exempt Rezoning

Rezonings that may be exempt include:

- a rezoning to correct an obvious or technical error in a previous planning scheme (s.38(1))

- a rezoning from one schedule to another in the same zone (s.3)

- a rezone to the Urban Growth Zone where the Growth Area Infrastructure Contribution applies (s.3)

- the first rezone from a Growth Areas Infrastructure Contribution area after 1 July 2023 (s.3)

- public land zoning (s.3)

- other types of zonings as declared by the Treasurer.

Transition arrangements

Land may be exempt from WGT if it was subject to a contract or an option that was entered into before 15 May 2021 where the transfer of the land has not been completed prior to the WGT event (s.39). For an option, the terms of the contract had to have been settled at the time the option was granted. Changing the terms of a contract after 15 May 2021 may cause the exemption to be lost such that WGT is applicable.

There are also some potential exemptions for rezonings that were already underway before 15 May 2021(s.40).

Who is liable to pay WGT?

The owner of the property is liable for the tax (s.8). Where there are joint owners they will all be liable for the tax as if there was a single owner (s.17). The trustee of a property owned by a trust will be liable (s.18).

The WGT remains as a first charge on the land until it is paid (s.42). If the purchaser obtains a relevant certificate from the Commissioner the charge on the land will be limited to the amount specified in the certificate, as is the case for land tax.

When is WGT payable?

Liability to pay WGT is incurred when the rezoning occurs (s.7). The owner will receive an assessment notice shortly after the rezoning setting out the amount of tax and when the tax is due. The owner has until the due date for payment specified in the assessment notice to apply to defer payment (s.31(2)). The Commissioner does have a discretion to accept an election to defer payment after the due date (s.31(3)).

Deferral incurs interest at the 10 year Australian government bond yield rate.

Payment can be deferred until 30 days after the earlier of the following:

- 30 years after the rezoning (s.32)

- a relevant acquisition occurs in relation to the corporate or unit trust landholder

- a dutiable transaction occurs in respect of the land, such as the sale of the land. There are some specific dutiable transactions that will not bring the deferral to an end as discussed further below.

Transactions that don’t attract duty because of an exemption under the Duties Act 2000 (Vic) may still constitute a ‘dutiable transaction’ in a WGT context and bring an end to a deferral of payment. Practitioners should warn clients about this risk.

Dutiable transactions and acquisitions that don’t trigger the payment of deferred WGT (s.28) are:

- acquisitions of economic entitlements of land

- no consideration dutiable transactions

- land owned and used by charities which is transferred to a charity to be used for charitable purposes

- acquisitions in landholders (i.e. a company or unit trust) that results from a pro rata increase in interests of all unitholders or shareholders.

- acquisitions of further interests in landholders

Notification of errors in the notice of assessment - time limit

Landowners are required to carefully check any notices of assessment and to notify the Commissioner if there are any errors that favour the landowner, such as additional land that should be included in the assessment. Failure to do so can attract penalties.

The owner has 2 months from the date of the notice of assessment to notify the Commissioner of any errors in the notice (s.26(2)), including the valuation. Practitioners need to advise their clients about this strict time limit as the Commissioner has no discretion to extend this date.

Calculation of the WGT

The WGT is calculated by determining the difference in value of the property as a result of the rezoning (i.e., the ’value uplift’).

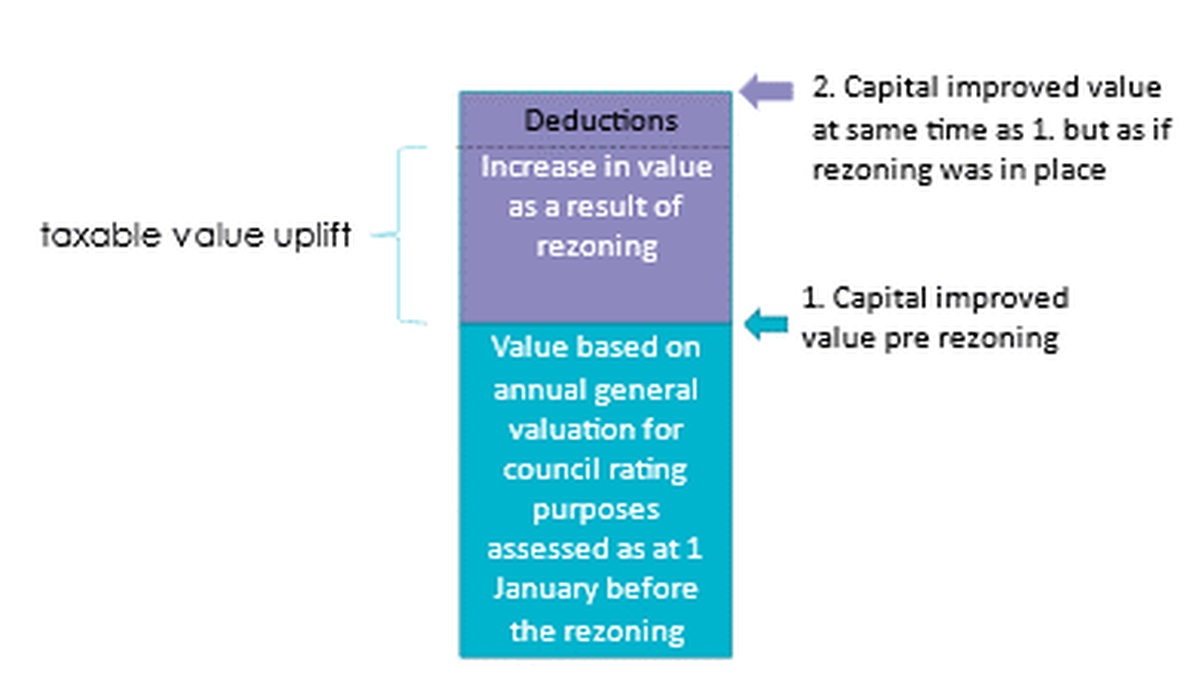

If the land has been valued for rating or levy purposes, the last assessment before the rezoning occurred is used as the pre-rezoning value. A supplementary valuation is then done as at the same date as the previous valuation - but as if the rezoning had hypothetically occurred on that date. If there is an increase in the value as a result of the rezoning, this is called the ‘value uplift’. The ’taxable value uplift’ is the value uplift less any available deductions and is used to calculate the WGT. Only taxable value uplifts of $100,000 or more attract WGT.

If an owner has more than one property that is affected by the rezoning, those are jointly assessed on the aggregate taxable value.

What is the WGT rate?

The WGT rate is nil where the taxable value uplift (the value uplift after deductions) is less than $100,000.

For taxable value uplifts between $100,001 and $499,999, the WGT rate is 62.5 percent. This applies to the amount of the taxable value uplift that exceeds the tax-free threshold of $100,000.

For taxable value uplifts of $500,000 or more the WGT rate is 50 percent. Note there is no tax-free threshold and this rate applies to the total amount of the taxable value uplift. The rate is lower given there is no tax-free threshold.

| Taxable value uplift | WGT rate | Windfall Gains Tax Formula |

| $0 to $100,000 | 0 | No WGT |

| $100,001 to $499,999 | 62.5% | WGT = (taxable value uplift – 100,000) x 0.625 |

| $500,000+ | 50% | WGT = taxable value uplift x 0.50 |

Risk management measures

- Solicitors and conveyancing practitioners need to read and understand the WGT legislation now.

- Practitioners negotiating the long term sale or purchase of land, which will settle after 1 July 2023, need to put their clients on notice of the risks of the WGT. If necessary, clients should be encouraged to seek specialist tax advice.

- If acting for the vendor, practitioners should seek instructions as to whether to transfer any WGT costs arising from the sale to the purchaser by way of a special condition.

- Practitioners acting for vendors who have land that is subject to a contract or option entered before 15 May 2021, and which may be exempt, need to advise clients that if the contract terms are significantly varied before settlement, the WGT exemption may be lost.

- Update checklists and precedents to highlight WGT risks and considerations.

- Advise clients as early as possible about the time limits and issues raised in this alert.

- Update precedent advice letters to warn clients of WGT risks and time limits, including:

- the 2 month limit to object to a WGT notice of assessment, and

- actions or events that might trigger the payment of deferred WGT.

- Conduct WGT training for all staff, including conveyancers, who act on real property transactions.

This alert was originally published on 15 February 2022 and subsequently updated on 16 June 2023.