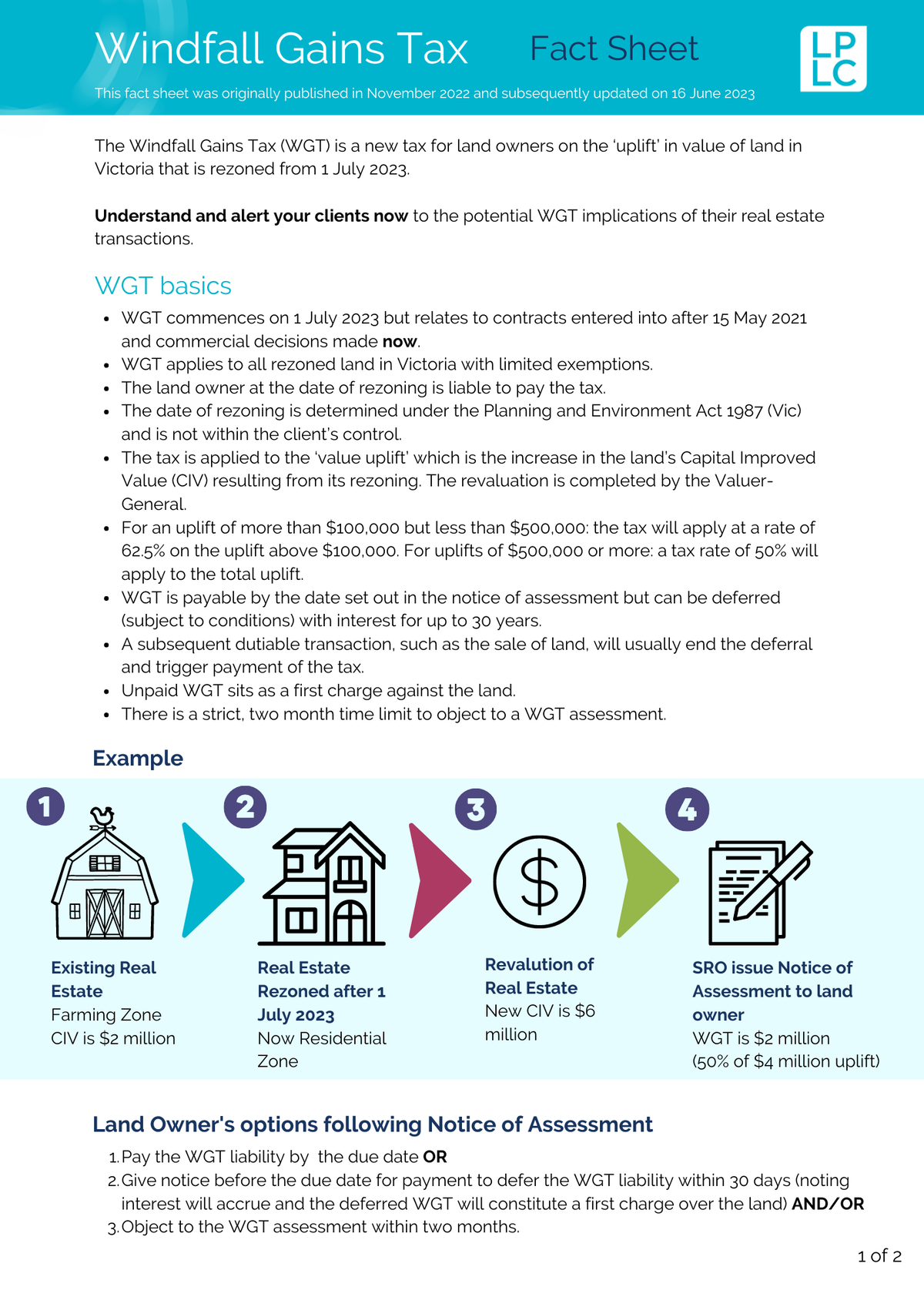

The new Windfall Gains Tax (WGT) will potentially impact real estate transactions that your clients enter into now, if those transactions relate to land in Victoria that is rezoned on or after 1 July 2023.

Clients should be alerted to the potential tax liability and how it may apply to them.

This fact sheet was first published in November 2022 and subsequently updated in June 2023.

On 12 October 2022 the State Revenue Office (SRO) published updated information and guidance on the WGT including frequently asked questions and answers about who is liable to pay the tax, how it is calculated, rights of objection and other important aspects of its application.

Practitioners assisting clients with property transactions and loans secured against real estate or planning work that involves rezoning or potential rezoning of land, should read and be familiar with the SRO’s updated guidance and understand how the new tax will impact their clients.

The SRO has noted on its website that ‘information on windfall gains tax will continue to be updated over the coming months’ and that practitioners can subscribe to SRO’s mailing list to be notified when further updates are available.

To further assist practitioners, LPLC has produced a new WGT fact sheet that provides a high-level summary of the tax and identifies some key risk management issues and measures that practitioners can implement now to avoid any surprises later.

Further Resources:

To learn more about the WGT regime, register for LPLC’s webinar on 15 November 2022. Register for this event here or watch the on-demand recording.

Also see LPLC’s Alert: New Windfall Gains Tax – what you need to know