Alert

There has been a spike in duty claims in the last 12 months. Practitioners handling conveyancing matters should review their knowledge and precedents about duty immediately to ensure they reflect the current law.

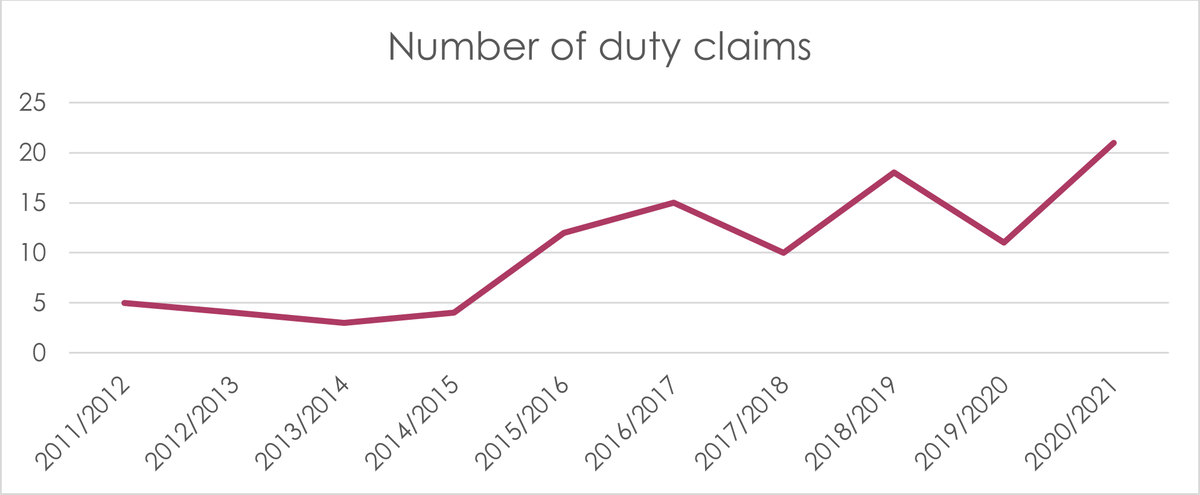

Our statistics tell us that the number of duty claims hovered around four or five a year until 2014/2015 when they moved into double figures and have continued to increase with over 20 claims and notifications in the last 12 months alone. The cost of these claims has risen dramatically this year with the rise in property prices and with the increased number of claims, as illustrated in the graphs below.

Two main aspects of duty law have contributed significantly to this spike:

- sub-sales involving nominations and land development; and

- foreign purchasers.

1. Nomination of substitute purchaser after land development

The most numerous and expensive duty claims in the last two years arose from nominations after land development.

Under s32J of the Duties Act 2000 (Vic) (Vic Duties Act), nomination after land development results in a sub-sale and a liability to pay a second amount of duty. Double duty will not be payable if nomination occurs before the land development activity [1].

The definition of land development under the Vic Duties Act is broad and includes applying for or obtaining a planning or building permit. It is irrelevant which party applies for the permit and the permit need not have been issued. Land development may also include:

- preparing a plan of subdivision or taking any steps to have the plan registered (this generally does not apply for off the plan sales because consideration is usually paid in the contract for the plan to be registered) [2]

- requesting an amendment to a planning scheme

- doing any building works that would require a permit or approval

- developing or changing the land in any other way that would enhance its value.

The State Revenue Office has published guidance on what constitutes land development.

Importantly the sub-sale can be triggered by nomination, even if the nominee is a related party or entity connected to the original purchaser.

In all sub-sale claims we have seen in the last two years, the purchasers applied for a planning permit before nominating, which triggered the sub-sale provisions and a second amount of duty. In all of these claims there was a long settlement period and in many of the claims there was an indication that the purchaser intended to develop the property. The nomination invariably occurred just before settlement.

In some claims the purchaser’s practitioners were unaware the planning application had been made before they assisted with the nomination. When double duty was subsequently assessed, the client complained the practitioner had either failed to warn the client at the beginning of the retainer of the risks of making an application if they intended to nominate; or to make enquiries of the client whether an application had been made before submitting the nomination form. In other claims the practitioner knew the application had been made but either forgot, due to the time delay between the application and the nomination, or was unaware of the sub-sale provisions and so didn’t appreciate the risk of double duty or advise on it.

Risk management

Advising the purchaser at the beginning of the retainer about the duty implications associated with the timing of land development and nominations, and then again before the nomination occurred, would have avoided these claims. LPLC strongly recommends conveyancing practitioners review their letters of advice to ensure they contain warnings about this issue.

For more information see LPLC’s:

- article: Double Duty and nominations

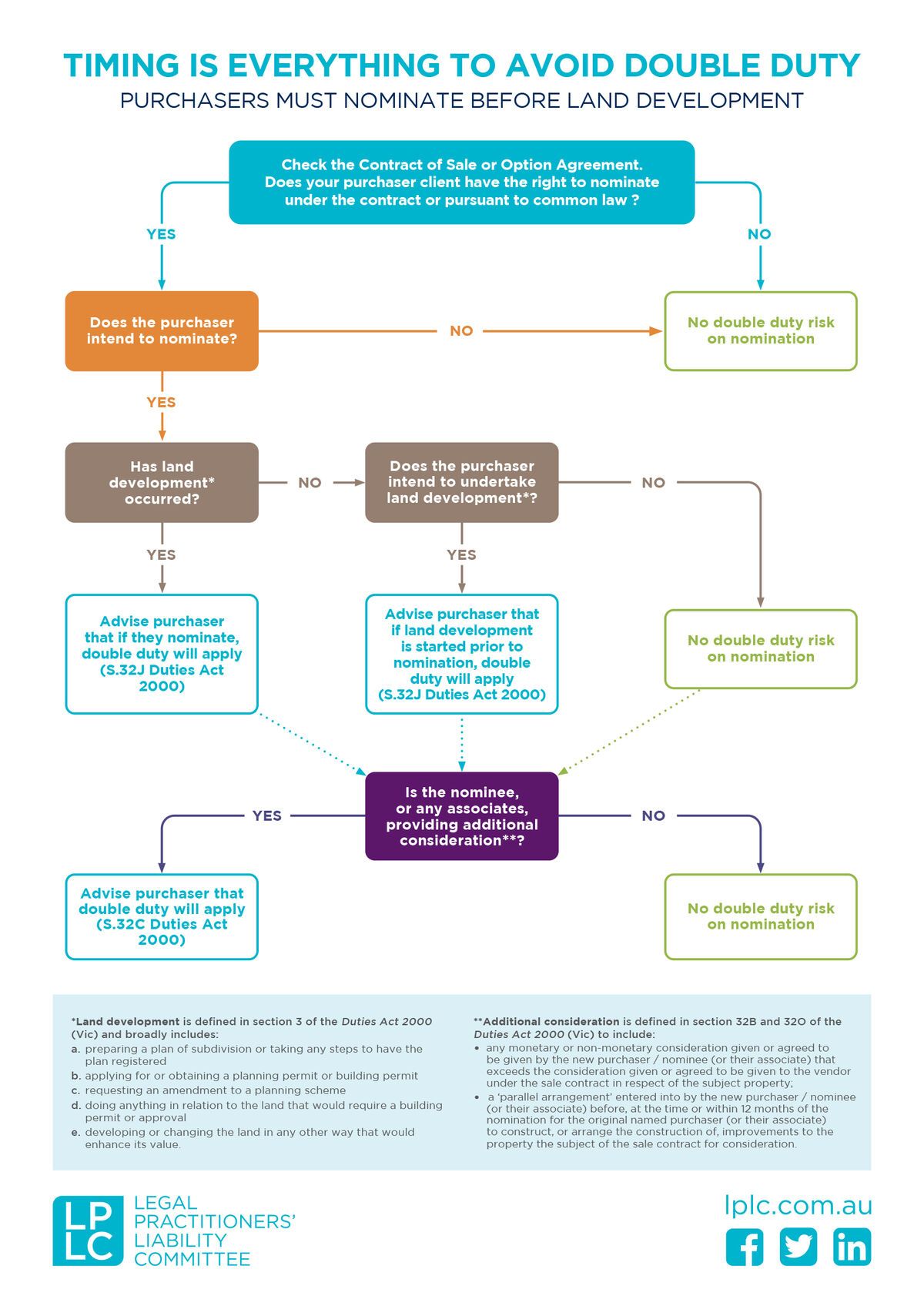

- double duty flowchart (see below)

- updated Purchaser’s practitioner checklist

Download double duty flowchart

Timing is everything to avoid double duty UPDATED V1 2 Nov21.pdf

2. Foreign purchasers

'Foreign purchaser additional duty' (FPAD) is the other significant area of duty claims. These have arisen from errors in a variety of contexts where purchaser clients have not been advised that FPAD would be assessed on the transaction. When the assessment is made, usually following SRO audit, the client seeks compensation for the penalty and interest components of the assessment. In cases where the additional duty could have been avoided, the client seeks to recover the whole assessment of duty plus penalties and interest from the practitioner.

Some examples of claim situations are:

- failing to advise about the duty implications of the client’s foreign status even when told the client held a foreign passport

- failing to advise New Zealand nationals that the FPAD would not apply if they hold a 444 special category visa at the time of settlement [3]. Given that 444 visas are only issued when a New Zealand citizen enters or is already in Australia, this means the purchaser must be in Australia when settlement occurs.

Foreign trusts — emerging issue

From 1 March 2020, the SRO changed its approach to FPAD in the context of acquisitions of residential property made by 'family' discretionary trusts. The change in approach has broadened the reach of FPAD in practice and results in many discretionary trusts that buy interests in residential property being treated as foreign trusts liable to pay FPAD.

A trust will be a 'foreign trust' for Victorian transfer or landholder duty purposes if a 'foreign' beneficiary holds a 'substantial' interest in the capital of the trust. ‘Substantial' generally means a beneficial interest of more than 50 per cent, alone or with associated persons. [4]

| However, under the Vic Duties Act, a standard discretionary or family trust will typically be deemed to be a foreign trust if, under the terms of the trust, the trustee has a power or discretion to distribute the capital of the trust, without limitation, to any foreign beneficiary or object of the trust, whether specifically named or simply a member of a general class. [5] | ||

Discretionary trusts can avoid being deemed foreign trusts if the trust deed expressly excludes any 'foreign' beneficiaries. The SRO accepts that amendments to a trust deed can prevent FPAD from arising, provided that the amendments are validly effected prior to the relevant dutiable transaction occurring.

The mistakes we are seeing involve practitioners not asking purchasers if they are buying the interest in residential property in the name of a family or discretionary trust. Alternatively, they did not consider the definition of foreign trust or appreciate that the SRO had changed its approach to family discretionary trusts.

Risk management

All conveyancing practitioners and clerks should familiarise themselves with the useful summary of the relevant ‘foreign purchaser’ provisions on the SRO website, including foreign natural person, foreign corporation and foreign trust.

Firms should review their:

- checklists and workflows to highlight the issue and ensure inquiries are made of foreign status early in the matter

- precedent early advice letters to ensure they include appropriate advice about the FPAD when relevant, so clients have ample opportunity to address and remove any unintended trigger for the FPAD liability if possible, such as nominating a different purchaser that is not foreign or amending the trust deed to expressly exclude foreign beneficiaries.

Clients should be advised to get expert advice as to the effect of any trust deed amendments, including the potential resettlement of the trust or other adverse tax or commercial consequences.

For more detail on this complex area, practitioners must read LPLC’s article: Foreign purchaser additional duty for discretionary trusts – what you need to know.

Footnotes

[1] Section 32C of the Vic Duties Act also imposes double stamp duty where 'additional consideration' is provided for the nomination, including by way of the original purchaser (or their associate) receiving consideration to construct or arrange improvements to the property either before, at the time of or within 12 months after the nomination.

[2] See section 32J(3)(a)

[3] See definition of foreign natural person in Section 3(1) of the Vic Duties Act.

[4] Section 3B(1) of the Vic Duties Act.

[5] Section 3B(2) of the Vic Duties Act.