'Foreign purchaser additional duty' (FPAD) provisions have now been in place in the Duties Act 2000 (Vic) (Vic Duties Act) since 2015.

From 1 March 2020, the Victorian State Revenue Office (SRO) changed its approach to FPAD in the context of acquisitions of residential property made by 'family' discretionary trusts. The change of approach has meant there has been, and will be, an increase in discretionary trusts found by the SRO to be foreign trusts liable to pay FPAD when acquiring residential property.

Practitioners practicing in conveyancing matters need to be aware of the way the FPAD regime works for discretionary trusts so that clients can be advised of its application.

What's on this page?

- Key takeaways

- Foreign purchaser additional duty — FPAD

- 'Foreign' discretionary trusts for the purposes of the Vic Duties Act

- Change in the SRO's administrative practice

- Residential property

- Absentee owner surcharge – land tax

- Some traps for practitioners

- Risk management action – discretionary trusts and FPAD

- Download foreign purchaser additional duty flowchart

- Appendix A – When a person or entity will be 'foreign' for the purposes of the Vic Duties Act

- Download a pdf of this article

We summarise the FPAD position in Victoria for discretionary trusts below, and also flag associated issues in Victoria and other states and territories.

Key takeaways

A trust will be a 'foreign trust' for Victorian transfer or landholder duty purposes if a 'foreign' beneficiary holds a 'substantial' interest in the capital of the trust. ‘Substantial' generally being a beneficial interest of more than 50 per cent. [1] |

However, under the Vic Duties Act, a standard discretionary or family trust will be deemed to be a foreign trust if, under the terms of the trust, the trustee has a power or discretion to distribute the capital of the trust to any foreign beneficiary or object of the trust, whether specifically named or simply a member of a general class. [2] |

Discretionary trusts can avoid being deemed foreign trusts if the trust deed is amended to expressly exclude any 'foreign' beneficiaries. The SRO accepts that amendments to a trust deed can prevent FPAD from arising, provided that the amendments are validly effected prior to the relevant dutiable transaction occurring. [3] |

Before amending the trust deed, clients should be advised to get expert advice as to the effect of the changes, including the potential resettlement of the trust or other adverse tax or commercial consequences. |

The concept of 'residential property' for FPAD purposes is very broad – it can include property that is intended to be developed as residential, even if that intention is formed post settlement. [4] |

A 'foreign' discretionary trust for FPAD purposes will generally not be an 'absentee trust' for 'absentee owner' land tax surcharge (AOS) purposes unless an 'absentee beneficiary' is specifically named in the trust deed, or otherwise specifically declared in writing pursuant to the trust deed, as a beneficiary as to income and/or capital. [5] |

Various other states and territories also impose stamp duty and land tax surcharges associated with acquisitions or ownership of land, or acquisitions of interests in 'landholder' entities, by foreign persons or entities. The surcharge regimes vary across jurisdictions. For example, NSW's foreign surcharge duty regime in the Duties Act 1997 (NSW) [6], requires an irrevocable exclusion of any potential foreign beneficiaries in a discretionary trust deed for a discretionary trust to avoid being treated as a foreign trust. [7] |

Foreign purchaser additional duty — FPAD

FPAD, currently at a rate of 8 per cent in addition to usual duty rates, will generally apply to the acquisition by a 'foreign purchaser' of an interest in 'residential property', as those terms are defined in the Vic Duties Act. There is an exemption (by application) for foreign corporations and foreign trusts that are Australian based and whose activities add to the supply of housing stock in Victoria in line with guidelines issued by the Treasurer. It is possible in some circumstances to obtain confirmation of the exemption from the SRO before settlement.

FPAD can also arise in the 'landholder duty' context. That is, where a foreign purchaser makes a relevant acquisition of an interest in a company or unit trust that directly or indirectly holds interests in residential property.

The definition of 'foreign purchaser' is very broad and includes foreign persons, foreign corporations and foreign trusts (see definitions in Appendix A). The focus of this article is on foreign discretionary trusts.

'Foreign' discretionary trusts for the purposes of the Vic Duties Act

A trust will be a 'foreign trust' for Victorian transfer or landholder duty purposes if a 'foreign' beneficiary holds a 'substantial' interest in the capital of the trust. ‘Substantial' generally being a beneficial interest of more than 50 per cent, alone or with associated persons [8]. The Commissioner of State Revenue may also have regard to whether a foreign person otherwise controls the trust. [9]

However, under the Vic Duties Act, a standard discretionary or family trust will be deemed to be a foreign trust if, under the terms of the trust, any capital beneficiary or object of the trust, whether specifically named or simply a member of a general class, is 'foreign' [10]. This is the case because the Vic Duties Act deems any potential capital beneficiary or object of a discretionary trust to be entitled to receive the maximum percentage of the capital of the trust that the trustee is empowered to distribute to that beneficiary. Under a typical discretionary deed, this would generally be 100 per cent. [11]

It is therefore very common for a discretionary trust to be 'foreign' for FPAD purposes, because discretionary trust deeds will frequently include classes of beneficiary such as:

- members of the extended family of a specified beneficiary, some of whom may be 'foreign'

- trusts or companies, whether Australian or 'foreign', in which a specified beneficiary holds an interest

- charities, whether Australian or 'foreign'.

For reference, see the summary table at Appendix A which outlines when a person or entity will be 'foreign' for the purposes of the Vic Duties Act.

Change in the SRO's administrative practice

Prior to 1 March 2020, the SRO applied a 'practical approach' by not treating 'family' discretionary trusts as 'foreign', provided that, broadly, 'foreign' beneficiaries:

- had not historically received trust distributions; and

- based on available information, were unlikely to receive trust distributions in the future. [12]

However, from 1 March 2020, the SRO has no longer adopted this 'practical' approach. The rule in section 3B(2) of the Duties Act 2000 (Vic) is now applied strictly to all discretionary trusts. FPAD will generally apply to a relevant transaction by the trustee of a standard discretionary or family trust if there is at least one 'foreign' capital beneficiary of the trust. This is regardless of whether that beneficiary is specifically named, and regardless of whether there has never been an intention to distribute to that beneficiary.

Whether a discretionary trust includes a foreign beneficiary is a question of fact and law in each case. Given the often broad categories of beneficiaries in discretionary trust deeds it is likely that many if not most discretionary trusts will include a potential foreign beneficiary and be deemed foreign trusts and without a clause specifically excluding foreign beneficiaries it may be costly and or difficult to prove otherwise.

The SRO accepts that amendments to a trust deed excluding foreign beneficiaries can prevent FPAD from arising provided that the amendments are validly effected prior to the relevant dutiable transaction occurring. [13]

In view of the above, practitioners acting in the purchase of residential property by discretionary trusts should consider whether the trust deed should be amended in order to expressly exclude any 'foreign' beneficiaries and advise the client of the consequences of doing so or not doing so. Considerations should include whether there would be any adverse income tax, duty or commercial issues arising from the amendment and the availability of an exemption from the FPAD.

Residential property

The FPAD generally applies to the acquisition by a 'foreign purchaser' of an interest in 'residential property'. The concept of 'residential property' is broad and will generally include interests in land such as freehold land, 'dutiable leases' and various other interests or deemed interests in land, that are used, or intended to be used solely or primarily for residential purposes [14]. Importantly, a 'foreign' purchaser or transferee has a continuing obligation to notify the SRO and pay FPAD if, at any time prior to or after settlement, the purchaser or transferee forms an intention to refurbish, extend, construct or undertake land development of a non-residential property so that it can be used solely or primarily for residential purposes [15]. Clients should be advised of this.

Absentee owner surcharge – land tax

It is worth noting that the 'absentee' concept in the Land Tax Act 2005 (Vic) is defined differently to the 'foreign' concept in the Vic Duties Act. A 'foreign' discretionary trust for FPAD purposes will generally not be an 'absentee trust' for AOS purposes unless an 'absentee beneficiary' is specifically named in the trust deed, or otherwise specifically declared in writing pursuant to the trust deed, as a beneficiary as to income and/or capital [16]. The current AOS rate is 2 per cent annually, in addition to usual land tax rates.

Some traps for practitioners

Is your client's purchaser / transferee entity a 'foreign trust'?

A trap for practitioners is failing to appreciate that their client is purchasing the interest in the property as trustee of a discretionary trust. This can occur if the practitioner doesn’t enquire whether the client is purchasing or taking the transfer in a trustee capacity, or if there is a 'last minute' nomination of a trustee of a discretionary trust as substitute purchaser prior to settlement and the implications of the nomination is not appreciated.

Does the transaction involve 'residential property' for the purposes of the Vic Duties Act?

Another potential trap is for a practitioner to misunderstand the breadth of the definition of residential property or the intention of the client to transform the property into residential property. This can result in mistaken advice that the FPAD will not apply. This trap is relevant regardless of whether the foreign purchaser or transferee is an individual, company or trust.

Risk management action – discretionary trusts and FPAD

- Ask your client if the purchaser or transferee or intended purchaser or transferee is acting in a trustee capacity.

- For discretionary or family trusts, warn the client that:

- if the classes of beneficiaries are broad enough to include any foreign persons or entities (see summary table at Appendix A), the trust will be deemed to be a foreign trust for the purposes of the Vic Duties Act

- FPAD will generally arise where the transaction involves residential property, as that term is defined in the Vic Duties Act, or land that is later intended to be used for residential purposes, subject to the availability of an exemption that must be applied for and granted by the SRO.

- If the above issues are raised with a client after the contract is signed and before settlement, give the client the options to:

- choose a different entity to complete the purchase if nomination is possible, or

- amend the relevant trust deed to exclude 'foreign' beneficiaries from the trust [17].

- If the client wants to nominate a new purchaser, advise about the potential for the 'sub-sale' provisions to apply if there is land development or additional consideration pursuant to Part 4A of Chapter 2 of the Vic Duties Act resulting in additional duty. See LPLC’s article Double duty and nominations.

- If the client wants to amend the relevant trust deed, they should obtain expert advice as to whether amendments to expressly exclude 'foreign' beneficiaries from the trust are:

- possible having regard to the terms of the trust deed and any potential adverse duty, income tax or commercial consequences

- necessary having regard to the nature of the transaction.

- If the trustee of the discretionary trust proposes to acquire an interest in land, or interests in a 'landholder' entity that holds land, outside Victoria, whether residential or otherwise, the duty and land tax surcharge regimes in each relevant jurisdiction should also be considered before entering into any contract of sale. Practitioners should seek advice from an expert in the relevant jurisdiction.

Download foreign purchaser additional duty flowchart

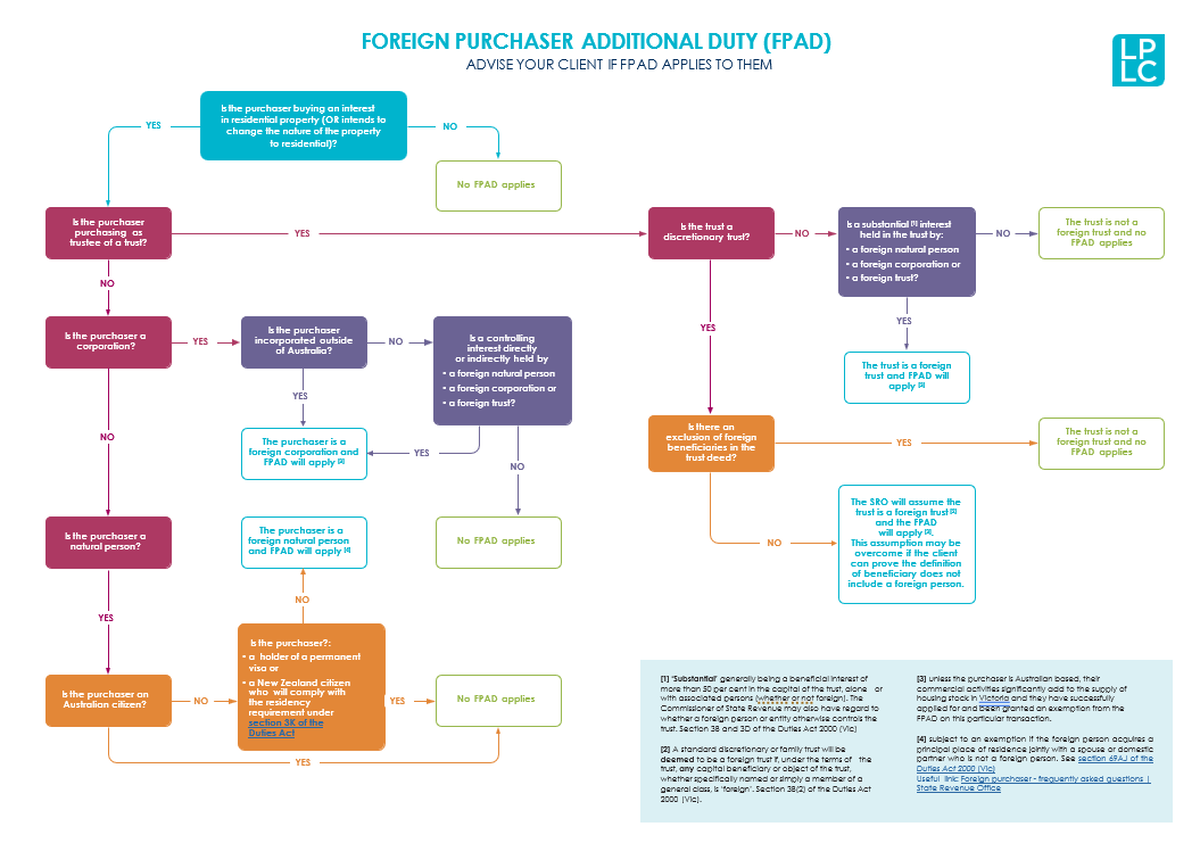

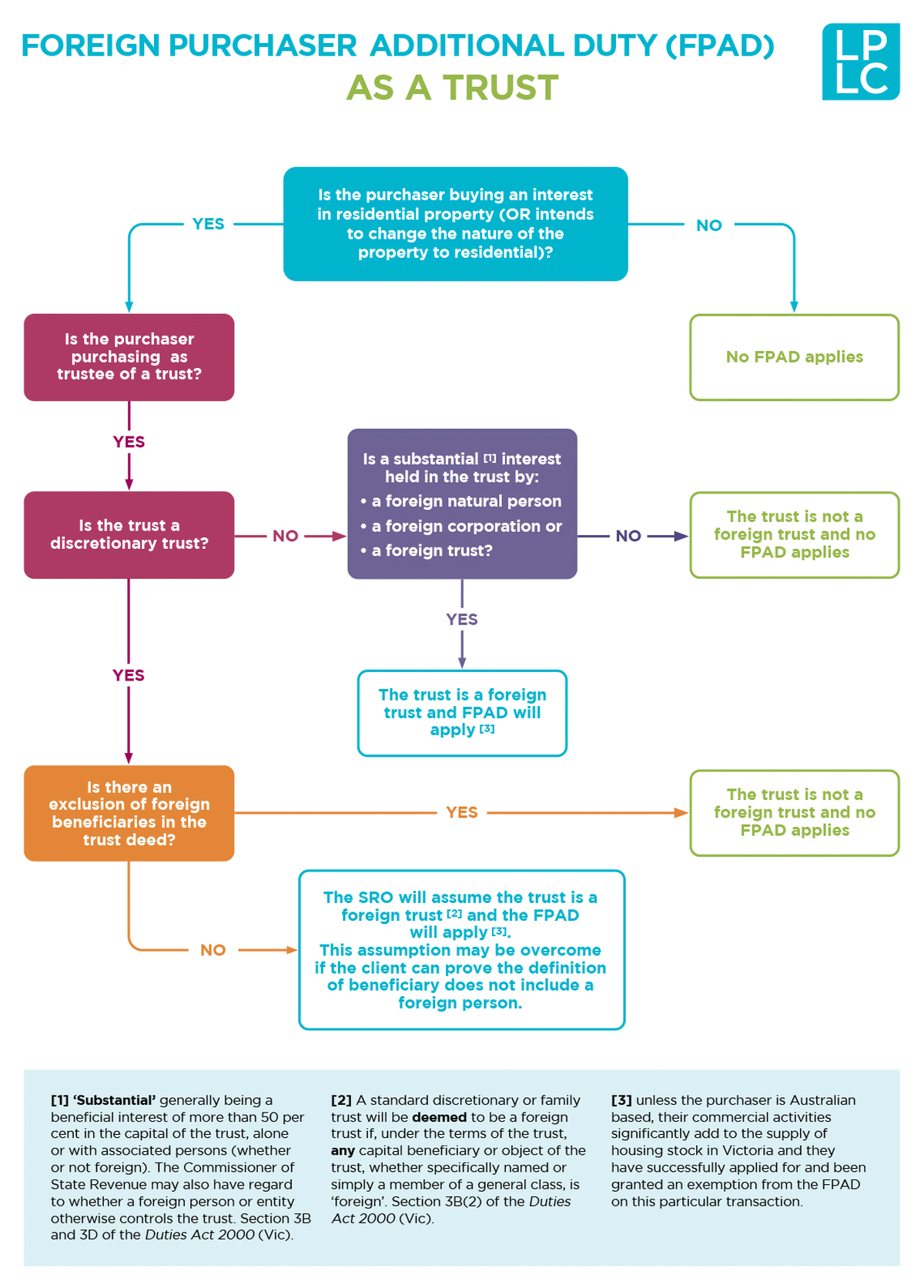

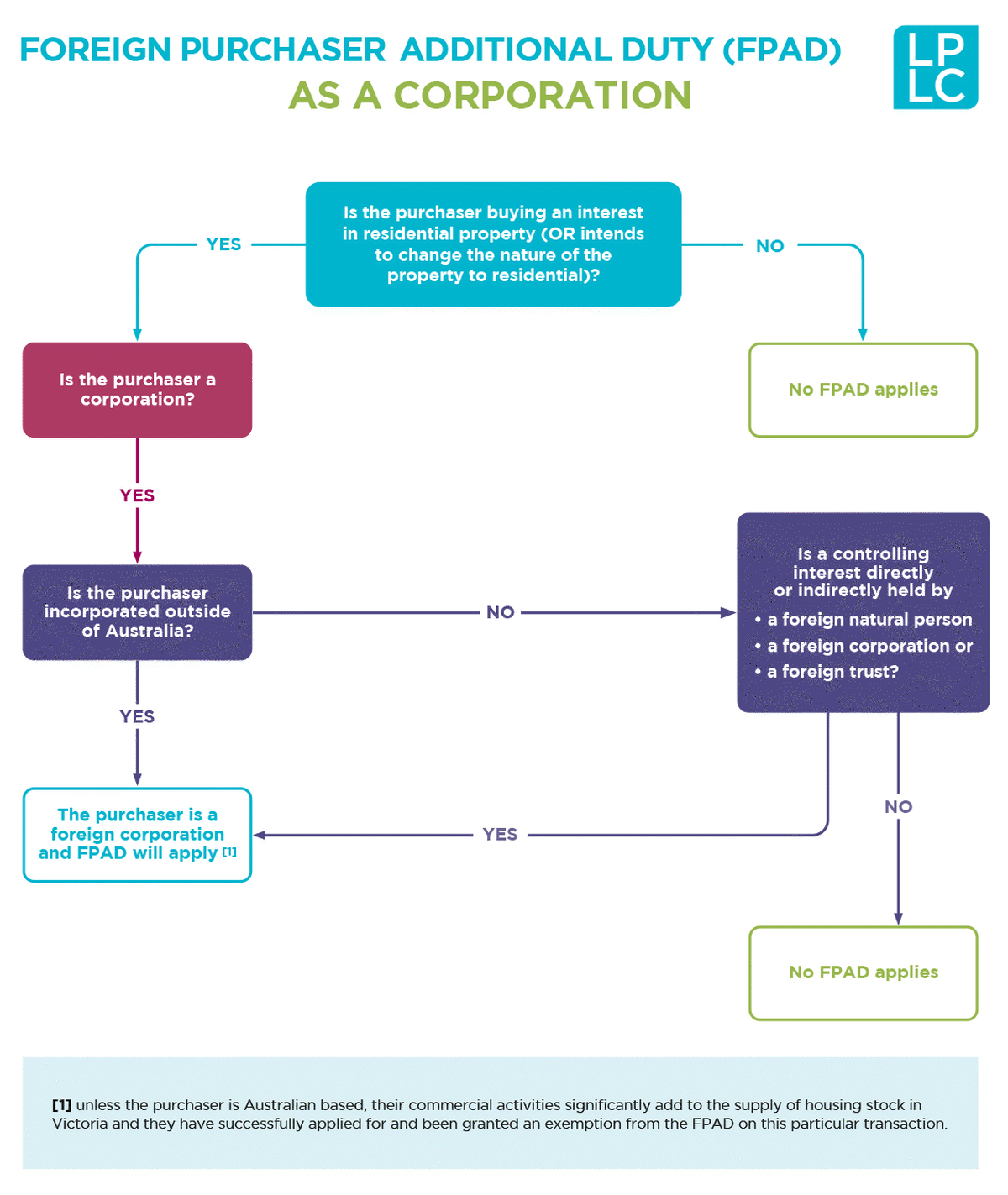

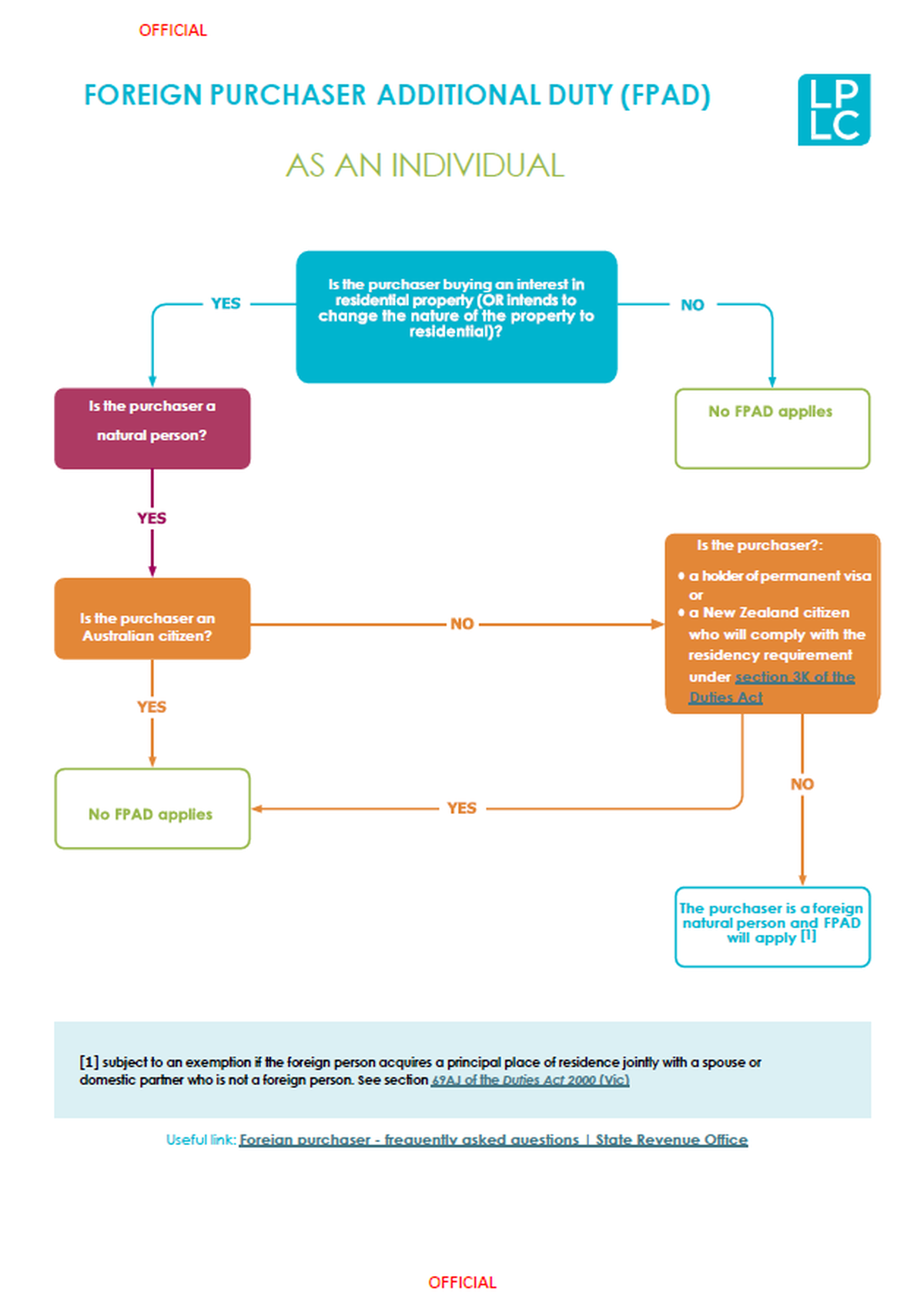

To assist practitioners LPLC have created 4 reference flowcharts that set out the relevant steps to consider if FPAD applies overall, and separated out into transactions involving a discretionary trust, a corporation and an individual.

Foreign Purchaser Additional Duty Flowchart 2025.pdf

Complete FPAD flowchart

Download below.

Appendix A – When a person or entity will be 'foreign' for the purposes of the Vic Duties Act

The table below outlines the circumstances in which a person or entity will be treated as 'foreign' for the purposes of the Vic Duties Act.

This is a summary only, so check the legislation, SRO website and note.

- different definitions apply for the purposes of determining whether a person or entity is an 'absentee person' for the purposes of the Victorian land tax 'absentee owner' surcharge; and

- various other states and territories also impose stamp duty and land tax surcharges associated with acquisitions or ownership of land, or acquisitions of interests in 'landholder' entities, by 'foreign' or 'absentee' persons or entities. The surcharge regimes vary across jurisdictions and care must be taken to review all applicable legislation and administrative guidance in detail.

| Foreign natural person (individual) [16] | A natural person who is not:

|

| Foreign corporation [17] | A corporation:

|

| Foreign trust [18] | A trust in which more than 50 per cent of the beneficial interests are held by one of more of the following, including interests of any associated persons, Australian or foreign:

Note, a beneficiary of a discretionary trust is taken to have a beneficial interest in the maximum percentage of the capital of the trust estate that the trustee is empowered to distribute to that person, usually 100% [19]. |

FPAD reference flowcharts as a Trust, Corporation and Individual

View charts here and download below.

Footnotes

[1] Section 3B(1) of the Vic Duties Act.

[2] Section 3B(2) of the Vic Duties Act.

[3] https://www.sro.vic.gov.au/foreign-purchaser-additional-duty-and-discretionary-trusts-2020 (retrieved 24 June 2021).

[4] Section 3G of the Vic Duties Act.

[5] Refer 'absentee trust' and 'specified beneficiary' definitions in section 3(1) of the Land Tax Act 2005 (Vic).

[6] Refer in particular sections 104I(1), 104K and 104L of the Duties Act 1997 (NSW).

[7] Section 104JA of the Duties Act 1997 (NSW).

[8] Section 3B of the Vic Duties Act.

[9] Sections 3B(1) and 3D of the Vic Duties Act.

[10] Section 3B(2) of the Vic Duties Act.

[11] Section 3B(2) of the Vic Duties Act.

[12] https://www.sro.vic.gov.au/foreign-purchaser-additional-duty-and-discretionary-trusts-2020 (retrieved 24 June 2021).

[13] https://www.sro.vic.gov.au/foreign-purchaser-additional-duty-and-discretionary-trusts-2020 (retrieved 24 June 2021).

[14] Section 3G of the Vic Duties Act.

[15] Section 18A of the Vic Duties Act.

[16] Refer 'absentee trust' and 'specified beneficiary' definitions in section 3(1) of the Land Tax Act 2005 (Vic).

[17] Note that for land in NSW the exclusion must also be irrevocable.

[18] Section 3(1) of the Vic Duties Act.

[19] Sections 3(1) and 3A of the Vic Duties Act.

[20] Sections 3(1) and 3B of the Vic Duties Act.

[21] Section 3B(2) of the Vic Duties Act.