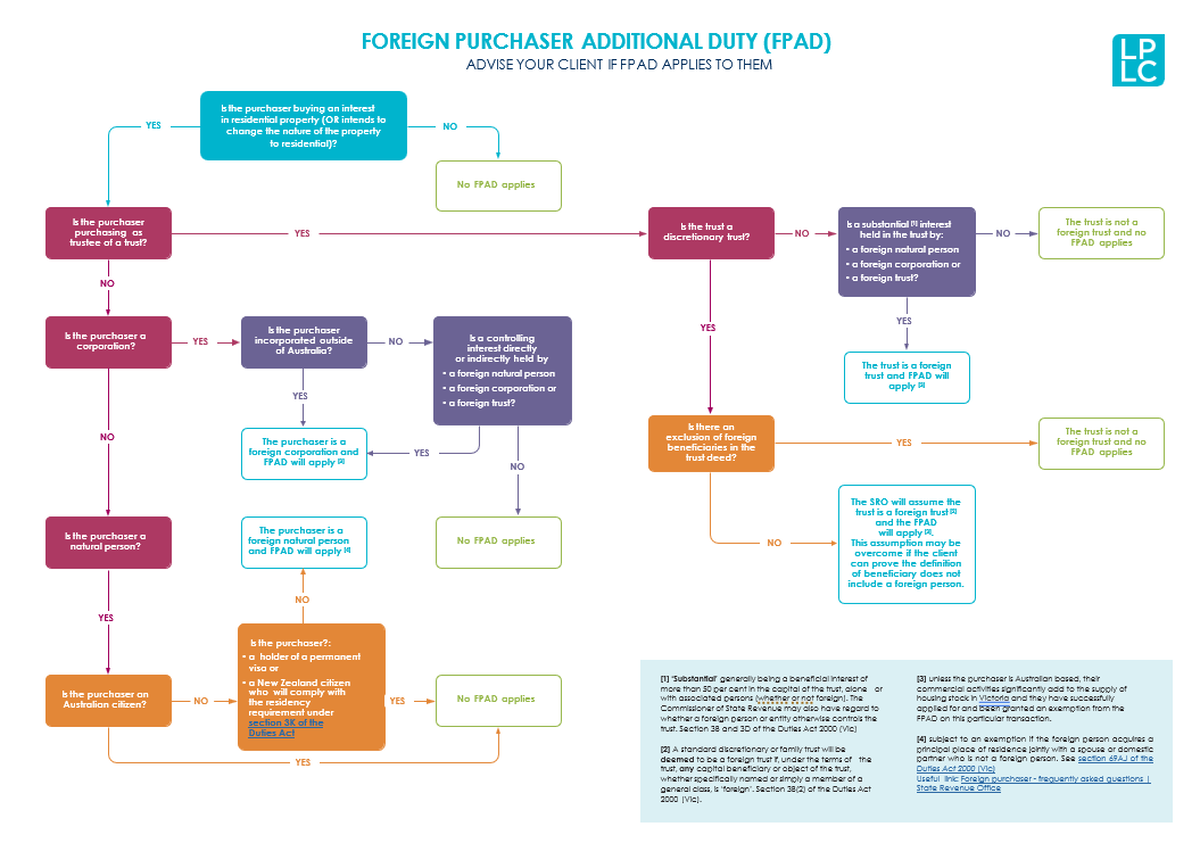

Practitioner flowchart

'Foreign purchaser additional duty' (FPAD) provisions have now been in place in the Duties Act 2000 (Vic) (Vic Duties Act) for over five years.

From 1 March 2020, the Victorian State Revenue Office (SRO) changed its approach to FPAD in the context of acquisitions of residential property made by 'family' discretionary trusts. The change of approach has meant there has been, and will be, an increase in discretionary trusts found by the SRO to be foreign trusts liable to pay FPAD when acquiring residential property.

Practitioners practicing in conveyancing matters need to be aware of the way the FPAD regime works for discretionary trusts so that clients can be advised of its application. Use this flowchart as a guide for providing advice clients about any applicable FPAD.